Returns on capex vary significantly for Vietnamese companies

/This crisis may tell us a few things about companies. First, which business models are most resilient (at least most resilient to a pandemic). Second, which companies are best at crisis management. Third, which companies have the underlying profitability to make it through a severe downturn.

My supposition here is that those companies that are not good at allocating capital (their investments don’t increase profitability) are likely to face a reckoning post-crisis. And those with good capital allocation will be the winners.

So let’s take a look at some of the bigger names of the Vietnamese market and see how their capital allocation decisions look. As a proxy, I decided to look at returns on capital expenditures. Basically, I want to know, if a company invests $1 in one year, does that equal $0.1 in additional earnings, or $1 or $10. The last would be amazing, while the first is equivalent to a return barely above the cost of capital. Turns out the range of outcomes is even wider than I thought!

Source: Vietstock.vn, Vietecon.com

Source: Vietstock.vn, Vietecon.com

For this exercise I took larger cap names along with some consensus favorites and looked at their capex from 2016 to 2018. Then I looked at the additional revenue generated from 2017 to 2019 (over the 2016 base). Generally, capex has been a good investment, both in terms of revenue, and in terms of net income (this is net income after tax and minorities).

On average, every dong of capex spent from 2016-18 added 2.3 dong in revenues and 0.20 dong in net profit in 2017-2019. For example using PNJ, the company spent VND539bn in capex from 2016-18. Its revenue increased by VND16,854bn in 2017-19 (above 2016 levels). Earnings also grew VND1.5tr in 2017-19 (above the 2016 baseline). This is a great return. If you told me that I could spent $10 to make $28 just over the next 3 years, I would do it 10 times out of 10.

This isn’t exact, because the company spent some capex in 2019 that probably boosted both revenues and earnings, and some capex spent in earlier periods before 2016 increased revenue and earning figures in 2017-19. For example, a store continues to produce earnings (hopefully) for many years after its built). But it is a good approximation of returns.

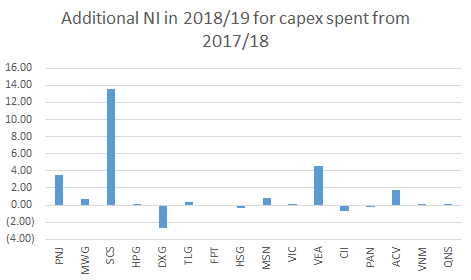

To make sure that I am not missing anything important, I ran the same exercise using capex from 2016 and 2017 to see what the additional revenue/earnings were for 2018 and 2019. The results are below.

Source: Vietstock.vn, Vietecon.com

Source: Vietstock.vn, Vietecon.com

Ultimately, the trend was the same, with some companies getting really high returns per dollar spent. Looking at earnings, these were:

PNJ: We talked about it above. New stores are wildly profitable and a great investment (at least for now before the market is saturated).

SCS: Surprisingly, logistics for SCS doesn’t mean high capital costs. The company had earnings of VND502bn in 2019 with net fixed assets of just VND496bn. That’s great. Seems like there is probably something behind these numbers, but interesting to look at.

VEA: I guess manufacturing new truck/tractor capacity is a good idea in Vietnam!

ACV: More airports are needed, and when built/expanded, they bring in good earnings.

Now looking at the worst performing:

DXG: I accidentally kept DXG in here (I took out all of the other real estate names). It’s a bit unfair, because what is capex in most companies (building buildings) is operating costs for DXG. And the falling net income could be due to timing differences for net income.

HSG: This appears to be somewhat company specific, because HPG, another steel company, doesn’t seem to have the same issues.

CII: The construction business has some of the same problems of timing as real estate.

QNS: Capex is surprisingly high, but we don’t really see a change in revenue.

Looking at these, there really doesn’t seem to be a specific trend that is driving performance. Retailers aren’t a bad bet, especially in a young-ish growing consumer country like Vietnam. And then some of the companies that service retail and growing consumption also invest well. As for what to avoid, it seems like its company specific.